Release Summary. Announces its 2018 releases of Quicken for Windows and Mac users with improved online bill management, new investment features, & more. Quicken 2018 Serial Key Features For Mac OS X: There are four versions of Quicken 2017, each one of which enhances the functionality based on the past one. Quicken Starter Edition expense and income administration, budgeting, and bill-pay. Dec 02, 2017 Very excited to see the large number of reviews that say that the 2018 Quicken for Mac version is good enough now for Mac users to not have to run a Windows virtual machine just to be able to use Quicken for Windows.

If you’ve finally had it with the Mac version of Quicken, we’ve taken a closer look at the best Quicken alternatives for Mac of 2019.

Quicken for Mac has lagged behind the Windows version for years and even though Quicken 2019 was an improvement, the decision to make it subscription only was the final straw for many faithful users.

The good news is that nowadays there’s some great personal finance software for Mac that not only do a better job, they don’t require a monthly or annual subscription to use.

Some of the apps featured here are even FREE like the excellent Personal Capital which blows Quicken out of the water when it comes to investment tracking and requires no subscription or commitments.

Apart from price, other reasons the apps here are better than Quicken include:

- Bank Syncing: Quicken is notoriously bad at syncing with bank accounts. You’ll find the apps here that support connecting to financial institutions far more reliable.

- Mobile Support: Quicken’s mobile app is limited and nowhere near as useful as the desktop app. Most of the apps here have well designed iPad and iPhone apps which are clear and easy to use.

- Investment Tracking: The Mac version of Quicken has never been good at tracking investments. You’ll find software here that do a much better job of managing car loans, home loan amortization, stocks, retirement funds and more. For a more specific look at investment apps, check out our look at the best investment software for Mac.

- Less Paperwork: By centralizing all of your accounts and bill payments with some of the tools here, you should also find that they help you if you want to create a paperless office on your Mac.

- Better Tax Tracking: You’ll also find that many of the apps here do a better job of preparing your accounts when it comes to filing taxes on your Mac.

You May Also Like:

With this in mind, here then is our list of the best alternatives to Quicken for Mac in order of ranking.

1. Personal Capital (Free)

Personal Capital is a superb tool to manage your finances and best of all, it’s actually free to use.

If you already use Intuit’s other budgeting tool Mint (see review later), you’ll really like Personal Capital because it’s got the same feel but with far more powerful investment management features.

Around 1.8 million people use Personal Capital and many of them have switched from Quicken, especially those with investments.

Here’s a summary of why Personal Capital is such a great replacement for Quicken.

- It’s free

Hard to believe for a personal finance software worth its salt but Personal Capital is 100% free to use for as long as you want with no limitations.

Personal Capital only charges you a small commission if you decide you want to maximize your investments via a personal consultation with one of its own Financial Advisors.

This is completely optional and not obligatory but is there if you want it.

- It syncs accounts seamlessly in one place

If you’re tired of constant syncing issues and problems with Quicken, Personal Capital is a breath of fresh air.

It syncs extremely well with all major financial institutions, aggregates your accounts and makes it easy to get an overview of your finances.

This includes checking, savings, 401k, mortgage and investment accounts.

That’s not to say that hiccups don’t happen as much depends on technical changes made by financial institutions but it’s so much more reliable than Quicken.

You can also download any transactions synced with Personal Capital in CSV format.

- It analyzes your investments to save you money

What makes Personal Capital different to many budgeting apps is that it also helps you save money on existing investments.

One of the ways it does this is via a fee analyzer and an investment analyzer.

For example, the retirement fee analyzer immediately identifies areas where you may be getting ripped-off or over charged with 401K admin or management fees.

The investment analyzer does the same for your investments to see where your existing investments and holdings can be diversified to improve your returns.

- It helps you plan for the future

By telling Personal Capital exactly how much income you expect to have in retirement, Personal Capital calculates exactly how on or off track you are.

It can also assess the impact on your 401k of major life events such as the birth of a child, illness, college fees etc. Or it can be used to assess how your immediate finances could be improved if you get a lump sum and eliminate expensive premiums by getting a free estimate on selling your life insurance policy.

There’s also a comprehensive cost of living retirement calculator which gives you useful insights into your average net worth by age.

In fact Personal Capital is easily the best retirement planning software for Mac available.

- It’s as secure as any bank out there

Like any major financial institution, Personal Capital is registered with the Securities and Exchange Commission (“SEC”) and has to adhere to the same security standards and procedures.

What’s reassuring about Personal Capital is that it doesn’t actually handle your log in details at all. It uses Yodlee which is a highly secure financial credentials management system used by major banks and investment institutions worldwide.

This is bank level, military grade security that’s about as secure as it gets nowadays.

Even if your account were somehow compromised, Personal Capital doesn’t actually allow transferring of funds via the interface so they cannot be touched anyway.

There are other measures that Personal Capital takes to encrypt and protect your data which you can read more about here.

- You can talk to a human if you want to

Sometimes an app just isn’t enough if you really want to grow your money.

Especially if you’re investing large sums, Personal Capital allows you to consult with a Personal Capital advisor who can make specific recommendations based on your personal situation and minimize tax liabilities.

You need a minimum of $100,000 to use this service and Personal Capital charges a commission for it but for serious investors, this is a unique bonus of the app.

Personal Capital obviously encourages you to use one its Financial Advisors but there’s no hard sell if you’re not interested.

- You can check your finances on the move

The Personal Capital iOS app is one of the best personal finance apps for iPad or iPhone we’ve tried, allowing you to manage and monitor your finances wherever you are.

It’s clear, easy to use and has lots of features compared to most mobile budgeting apps.

Quicken vs Personal Capital

| Quicken | Personal Capital | |

|---|---|---|

| Subscription Fee | ||

| Lifetime License | ||

| Easy To Use | ||

| All Accounts In One Place | ||

| Financial Advisors Available | ||

| Personalized Investment Strategy | ||

| Fiduciary | ||

| Smart Indexing | ||

| Mobile App | ||

| Customizable Portfolios | ||

| Tax Loss Harvesting | ||

| 401k Fund Advice | ||

| Portfolio Risk Assessment | ||

| Compare Mutual Funds | ||

| Track Cost Basis & Capital Gains | ||

| Income & Expense Projection | ||

| Spending Targets | ||

| Price | $74.99/year (Premier) | Free |

Free Account Sign Up |

So what are the drawbacks to all this? Well, like any finance tool for Mac Personal Capital is not perfect.

The biggest gripe we have with Personal Capital is that you can’t import Quicken QIF or QFX files. This is definitely disappointing if you have years of Quicken accounts although even apps that do import Quicken files don’t usually do it very well due to the complexities of the format.

However, this is less of an issue now anyway since Quicken 2019 has removed the option to export files in QIF format from the Mac version anyway (although the Windows version of Quicken still exports to QIF). Quicken for Mac now only exports in QXF which is a proprietary Quicken format that can’t be imported into any program. Therefore, there’s no way to import Quicken 2019 files into Personal Capital unfortunately.

Quicken Premier 2018 For Mac

Unfortunately as well, you can’t change transaction dates in Personal Capital. If you have a fixed payment (such as salary or pension) that posts on the 1st of every month and it falls on a weekend or holiday, the transaction will appear in Personal Capital as the last banking day before that. This means Personal Capital will show that you have a double payment in the same month which messes up your budget.

Finally, another slight drawback to Personal Capital is that it doesn’t help you much at tax time. Although there’s dedicated tax software for this, there seems little reason why Personal Capital can’t make things easier when it comes to declarations.

Overall though, Personal Capital not only helps you budget better but it manages your investments too and it’s so convenient to have that all in one app.

For more information, you can check out our full Personal Capital review.

You can also open a Personal Capital account for free to judge for yourself.

Pricing: Free

2. Moneyspire

If Cloud based apps are not your thing and you want a dedicated Mac desktop app, Moneyspire 2018 (formerly Fortora Fresh Finance) is an excellent no-nonsense personal budgeting software for both Mac and Windows.

Moneyspire doesn’t store your accounts in the Cloud, doesn’t require you to upgrade regularly or subscribe like Quicken and you can download it onto your Mac.

Even better, at the moment, Moneyspire is 40% off at just $29.99 compared to the normal price of $49.99 which is definitely a good deal for a desktop personal finance software for Mac on this level.

You can import QIF files from Quicken and likewise, export your accounts to QIF if you move back to Quicken at a later date.

If you’ve got a lot of accounts saved in Microsoft Money on Windows, Moneyspire can also import MS Money files.

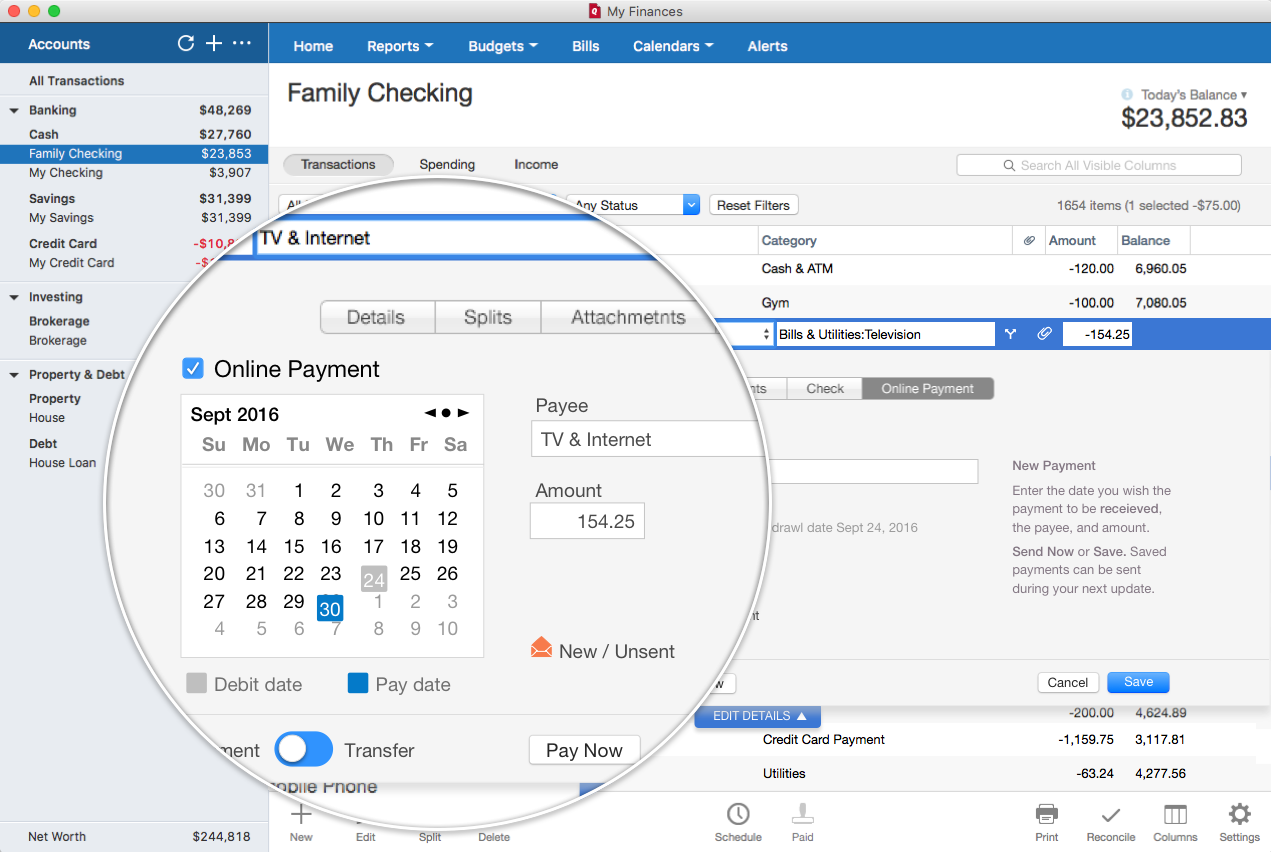

Moneyspire supports online bill payments though via both Direct Connect and its own Moneyspire Connect service both of which are free to use.

Moneyspire Connect supports over 15000 financial institutions so it’s safe to say, your bank is probably supported if Direct Connect doesn’t work for any reason.

Like many personal finance app bank syncing services, Moneyspire Connect doesn’t always work perfectly but this is often due to security changes on the bank side.

Generally, you’ll probably find Direct Connect more reliable although that isn’t without its problems too.

Moneyspire is a very complete alternative to Quicken on Mac which tracks bank accounts, credit cards, loans, investments and more.

You can set bill reminders, budgets and generate detailed reports and charts to monitor your outgoings and if you run a small business, you can also create professional invoices and track payments.

It can even print checks which most finance apps no longer support anymore on Mac.One of the things we like most about Moneyspire is that it doesn’t over complicate things. It gives a very clear overview of everything from accounts and details of spending to bill reminders and budgets.

The Bill & Deposit Reminder provides a very clear overview of upcoming payments:

You can generate detailed reports and charts to see exactly where your money is going to make tax reporting less stressful and much easier.

Other useful features in Moneyspire include Balance Forecast, Reconcile Statements, Online Banking, Import & Export of Data and Cloud syncing.

Reconciling of accounts in particular is a very useful feature when it comes to budgeting and you can see how it works below.

For mobile users, there’s a free Moneyspire app for iPad and iPhone which allows you to check your account balance, edit transactions, see upcoming bills and keep an eye on how your budget is doing.

Moneyspire used to be available in different versions but has now simplified its pricing policy and there’s now just one version of Moneyspire for $29.99 which includes Direct Connect access.

Normally it retails for $49.99 so that’s 40% off.

The impressively reliable Moneyspire Connect service is even included in the price (which previously used to cost an extra $49.99 per year).

If you do decide to purchase it, you have a 60 day money back guarantee if you’re not happy with it.

Unlike with Quicken, updates to Moneyspire are free but major updates usually require an upgrade fee.

You can also try Moneyspire on Mac for free if you want to see what it’s like for yourself.

You can also check our full Moneyspire review for more.

Pricing:$29.99 (40% off – normally $49.99) – Free Trial

3. Banktivity

Banktivity (formerly iBank) is designed specifically for Mac and has long been one of the most popular desktop replacements for Quicken on Mac.

Long before Quicken for Mac, Banktivity supported things like online banking integration, bill pay, envelope and full year budgeting, loan amortization and multi-currency support.

Some of these things have now been introduced in the latest version of Quicken 2018 for Mac but Banktivity still remains an excellent personal finance app for macOS.

Here are some of the things we like the most about Banktivity:

- Account Importing

Banktivity will import your accounts from Quicken and other finance software.

Although it’s not perfect, the import tool does a pretty good job and saves valuable time manually entering old accounts. You can see how this works below.

- Bank Syncing

Banktivity will automatically connect to and download transactions from your bank or other financial institution in real time.

It offers various ways of doing this with the most reliable and widely supported being Direct Access.

Direct Access is Banktivity’s own syncing service and generally works very well although it costs an extra $44.99 on top of the cost of Banktivity. Other free ways of connecting are available though.

- Detailed & Customized Reports

The reports generated by Banktivity are very well-organized due to tags and categorization.

There are Quick Reports for instant overviews of the essentials and you can create highly customized reports for virtually any kind of spending.

- Budgeting

Banktivity supports traditional and envelope budgeting with useful setup wizards to get you going.

You can filter budgets by time frame to see exactly when you’ve gone under or over budget and set budgets for scheduled and unscheduled expenses.

- iPad, iPhone and iWatch Apps

Banktivity is designed exclusively for the Apple ecosystem with iOS apps to help you monitor and enter transactions on the move.

The apps sync with the desktop version of Banktivity and there’s even an iWatch app with spending alerts to help keep you on budget.

Investment management isn’t Banktivity’s strong point but there is a separate free Banktivity Investor app (formerly iBank Investor) which syncs investment data specifically.

So for example, you can see all of your holdings with the current gains or losses in real time with data pulled from Yahoo Finance.

Banktivity 6 costs $64.99 but you must pay an additional $44.99 per year for Direct Connect access.

You can also try a 30 day free trial.

For a more in-depth look, you can also read our full Banktivity review.

4. Moneydance

Moneydance has many satisfied customers that previously used Quicken and is an excellent desktop equivalent to Quicken on Mac.

Moneydance has all of the features of Quicken including online banking and bill payments, bill attachments and arguably has better investment tracking and budgeting tools than Quicken.

Moneydance is particularly good at handling investments and transactions in multiple currencies so is an excellent choice for those that hold investments or make purchases in currencies other than US dollars.

Moneydance provides a very clear overview of your finances. It gives you all the essentials such as account balances, upcoming and overdue transactions and exchange rate information.

The calendar overview is particularly useful for a quick oversight of upcoming credits and debits so you can manage your finances for that month more easily.

Moneydance can import Quicken files in QIF format although we noticed several duplicate transactions which had to be manually adjusted.

Moneydance can automatically download transactions and make bill payments online to hundreds of financial institutions. However, online banking is only available via Direct Connect and we found this can be tricky to setup in Moneydance.

Moneydance can sometimes be unreliable at retrieving bank data especially from credit card accounts and there’s no enhanced online bank connection service that you can pay extra like with Moneyspire and Banktivity.

Investment tracking is also easier to navigate and more powerful than Quicken, with support for stocks, bonds, CDs and mutual funds among others.

You can see the total value of your investments or the performance of individual stocks and mutual funds over time. Moneydance will also download stock prices automatically in real time.

• If you already added an email account, you can still add more. Select an account type—if you don’t see your type, select Other Mail Account—then enter your account information. In Mail, choose Mail > Add Account, select an account type, then enter your account information. Make sure the Mail checkbox is selected for the account. • If you’re using an account on your Mac with other apps, such as Contacts or Messages, you can also use that account with Mail. Best email app for mac 2018.

Moneydance also has some powerful reporting tools that compare favorably with Quicken and it can generate reports for any of your accounts, savings or investments.

The Moneydance iPad and iPhone apps are both free so you can manage your budgeting on the move although it’s only really useful for manually inputting transactions.

Slightly concerning though is the fact that Moneydance only syncs the Mac and iOS app via Dropbox which doesn’t feel very secure compared to Banktivity’s encrypted Direct Access features.

You can also extend its functionality with add-ons and extensions for such things as a Balance Predictor, Debt Insights and a Find and Replace extension.

Overall Moneydance is a solid financial software for Mac to replace Quicken especially if you need reliable online banking integration.

Moneydance is $49.99 from the Mac App Store with a 90 day money back guarantee and there is also a free Moneydance demo for up to 100 transactions.

You can also check out our full Moneydance review.

Pricing: $49.99

5. Mint

Mint is owned by Intuit the makers of Quicken and is basically a free, lighter and less powerful version of Quicken.

The biggest difference between Mint and Quicken is there is no automatic online bill pay feature in Mint so if this is a deal breaker for you, move on.

Mint has improved a lot over the years and has faced less criticism than Quicken, partly because it doesn’t cost a cent to use.

In fact many people use Mint for day-to-day budgeting alongside Personal Capital to manage their finances.

Mint is all about getting your money in order and is based around three things:

- Budgeting: Mint will automatically suggest a budget for you based on your income and goals. You can factor in one off expenses and of course recurring monthly costs.

- Bill Tracking: All your bills are clearly labelled and managed in one place. You can see when bills need paying and set alerts to let you know before they’re overdue.

- Credit Score Analysis: Mint performs a free credit score analysis if you verify your identity. It also gives you recommendations on how you can improve it.

- Spending Summary: You get a weekly summary of where your money has gone. This is useful for seeing which areas you’re spending most in and is handy to compare month-by-month. Mint will also alert you to unusual or large transactions.

- Spending by Category: Mint can also categorize transactions to make it clearer where you spent your money. If you’ve ever looked through your bank statement and can’t understand the codes and jargon used for certain transactions, this is useful. It also separates ATM withdrawal amounts from ATM withdrawal fees so you can see just how much your spending in charges and other hidden fees.

- Investment Tracking: The investment tracking features in Mint are very basic and certainly nothing like the financial tools in Personal Capital but for 401(k) accounts, mutual funds and IRAs it gives a basic overview.

Mint also has one of the best mobile apps out there for budgeting. The Mint iPad and iPhone app looks good, gives a clear overview of your finances and is easy to navigate.

The biggest problem you”ll encounter with Mint is connecting to banks to update your accounts.

Like many personal finance apps, Mint can take time to update your balances and transactions and can be affected by changes made by your bank to the way third-party apps communicate with it.

Sometimes this means you have to delete an account in order to reconnect it and the problem with this is that you lose your account history in Mint.

It’s also important to note that although Mint and Quicken are both Intuit products, there is no integration between Quicken and Mint. They are completely separate products.

Overall however, as a more basic free alternative to Quicken, Mint is an excellent budgeting tool for Mac users.

Pricing: Free

6. SEE Finance 2

SEE Finance 2 is designed specifically for Mac and used to be the closest thing you could get to Quicken before Intuit finally released Quicken for Mac.

Despite the launch of Quicken, the makers have continued to develop SEE Finance into a very reliable, robust and feature packed personal budgeting app for Mac.

In fact the latest version of SEE Finance 2 has been built from the ground up and is a big improvement on SEE Finance 1 in terms of both looks, functionality and affordability.

We found that SEE Finance 2 is one of the best personal finance software for Mac when it comes to importing Quicken QIF data accurately.

Unlike apps such as Banktivity and Moneydance, there’s less chance of duplicated transactions when importing large QIF files into SEE Finance. You can import files in QIF, QMTF, CSV, QFX and OFX format.

Investment tracking is also very well done in SEE Finance 2 with a clear and varied overview of your investments with lots of different reports.

SEE Finance 2 is also very good at handling multiple currencies with over 150 different currencies supported.

You can connect to banking institutions via Direct Connect which will automatically download transactions and import data from others.

This is easy to setup and use in SEE Finance and pretty reliable at syncing and updating account. Note however that SEE Finance 2 does not support Bill Pay.

More recently there’s now an SEE Finance iOS app for iPhone and iPad that syncs with the Mac version via iCloud. It also works with OFX Direct Connection downloads if your bank supports it.

SEE Finance 2 is a massive improvement on the first version and remains a fast, reliable and slick app to manage your finances on Mac.

Note that SEE Finance 1 is still available in the Mac App Store but we strongly recommend using SEE Finance 2 instead as it’s far more modern, includes an iOS app and is more likely to be supported by the developer in the future.

You can also try a 30 day free trial of SEE Finance.

Pricing: $39.99 – Free Trial

7. YNAB

Although You Need a Budget (YNAB) can’t fully compare with Quicken, if it’s mainly budgeting you use Quicken for, it’s definitely a contender.

YNAB claims that new users save on average $200 in their first month and more than $3000 by month nine although this of course won’t be true for everyone.

Because of the way it approaches budgeting, YNAB has proved very effective at helping users to save money and get their finances in order which is made it very popular with Mac and PC users alike.

More recently, it’s now added online banking support via Direct Connect to conveniently sync and update all of your accounts and transactions in one place so you can keep tabs on your money better.

There is no support in YNAB for Bill Pay however.

The developers of YNAB strive to help you manage your money more efficiently by encouraging you to use a Four Basic Rule method which can genuinely help you save money or get out of debt.

The four golden rules are:

- Give Every Dollar A Job: Every cent is accounted for

- Embrace Your True Expenses: Break down large purchases into monthly payments

- Roll With The Punches: Create an overflow for the unexpected

- Age Your Money: Deal with bills as they happen

YNAB is structured around these four principles and helps you to structure your budget accordingly.

YNAB can import bank files and transaction ledgers and can retrieve your balances from over 12,000 banks.

Note that there’s no support for Direct Connect or Bill Pay though.

YNAB also does not support multiple currencies or investment tracking so it’s not really suitable for those who have a big investment portfolio.

It does however allow you to factor mortgages and simple investments into your overall budget and gives you a very clear overview of where your money is going.

YNAB is also one of the only personal finance apps that has an iWatch app but even more unusual, an Alexa app which can automatically check category balances or record new spending at your command.

Although YNAB can sync across all devices, note that it uses Dropbox for syncing and doesn’t offer its own Cloud syncing service or syncing via iCloud.

Is still free and available outside of Office, regardless of the platform. Outlook has updated contact cards, support for Office 365 Groups, mentions, a focused inbox and new summaries for deliveries and travel. Ms office 2016 for mac amazon. Only trusted commercial volume customers have a crack at Office 2019 right away.

YNAB now costs $4.99 a month or $49.99 per year direct from the developer.

If you’re a US college student, YNAB is absolutely free.

You can also try a 34 day free trial of YNAB before deciding whether its for you or not.

If you’re struggling to make ends meet at the end of the month, YNAB is an excellent straightforward budgeting alternative to Quicken.

Pricing: $49.99/Year – Free Trial

8. CountAbout

CountAbout is a simple but effective budgeting app that can import Quicken QIF files and Mint files.

The Quicken import tool is one of the best we’ve tried and accounts are imported with very little need for manual adjustment.

CountAbout automatically downloads transactions from your bank including investment balances like 401k’s. There is no support for Bill Pay though.

CountAbout offers two subscription plans – one for $9.99 per year and a premium subscription for $39.99 per year.

The difference is that the Premium subscription includes Direct Connect which allows you to automatically download transactions from bank, credit card and investment institutions.

CountAbout is very good value for money and considerably cheaper than most personal finance software that supports Direct Connect.

You can see a quick overview of what CountAbout can do below.

Pricing: $9.99/year or $39.99/year with Direct Connect

9. MoneyWell

MoneyWell is a slick, simple but effective Quicken alternative designed specifically for Mac.

MoneyWell is unique in that it uses an envelope budgeting system to help you manage your finances better.

Rather than setting targets that you either hit or miss, envelope budgeting works on the basis that any money you save or overspend is constantly adjusted to show the effect on your incoming bills.

MoneyWell also supports Direct Connect so that you can automatically pay bills from your bank account.

MoneyWell is clearly well thought out with some really smart interactive reports. In fact the graphs and reports in MoneyWell are some of the best we’ve seen in any budgeting software at this price.

Unfortunately, there’s no longer a mobile app though. MoneyWell Express was the mobile version of MoneyWell but was discontinued in early 2018 due to syncing issues.

Quicken 2018 Windows Review

MoneyWell costs $72.60 but you can also try it for free.

Pricing: $72.60 – Free Trial

10. MoneyWorks

Finally, if you’re looking for something that can double as both a budgeting app and accounting software on your Mac, MoneyWorks might be for you.

Productivity software pack for mac. – Quip is a powerful productivity suite that enables you to collaborate on any device. – Airdroid lets you wirelessly manage, control and access to Android Devices from a web browser. – Simplenote is a light, clean, and free note-taking app. – Slidedog is a simple, free presentation software.

MoneyWorks was one of the first ever finance apps for Mac and made its debut on OS X way back in 1992 – before Windows 95 was even invented.

If you’re a treasurer and use Quicken to keep track of your organization or company budget, MoneyWorks may be ideal for you as it’s designed for small businesses, organizations and accountants in mind.

MoneyWorks can import data from QuickBooks, MYOB, Xero and Greentree although it doesn’t support importing Quicken data.

MoneyWorks also doesn’t support Direct Connect or Bill Pay though so it’s not suitable for those that want to sync it with their bank.

MoneyWorks is however well-integrated with other business software on Mac including Daylite, FileMaker, Numbers and Microsoft Office.

If you need something that can manage payroll, CRM and POS systems on Mac, then MoneyWorks is a particularly good choice.

MoneyWorks is also generally very good at representing complex business data in graphs and produces custom reports via the MoneyWorks Gold report writer.

It’s also a good option for those that need to share their accounts with Windows-based accountants as it works on both Mac and PC.

MoneyWorks comes in 5 different versions aimed at differing sizes of business and all are available for standalone purchase or via subscription.

MoneyWorks Cashbook is completely free to use and is ideal for small organizations that need a simple financial management solution.

You can also try MoneyWorks free for 45 days.

If you’re looking for a Quicken alternative with a focus on accounting and cashflow, MoneyWorks is a powerful solution for Mac users

Pricing: Free/$18 per month+/$249+

Which Is The Best Quicken Alternative For Mac?

If you’re looking to maximize your investments as well as manage your budget, then Personal Capital is still the best of the lot.

The fact that you can use it completely for free is obviously a massive advantage compared to any other personal finance tool out there.

It also just makes budgeting and maximizing your assets so easy compared to Quicken and it also looks like something that’s made for Macs compared to Quicken which was originally made for Windows and later ported to Mac.

Considerations When Replacing Quicken

The best Quicken alternative for you really depends on your specific needs. Some people need things like Bill Pay and Online Banking while others are more focused on investments.

To help you in your decision though, here’s a checklist of features to bear in mind when deciding which Quicken replacement to choose.

You can see whether the application you’re interested in supports these features by checking the comparison table above.

- Online Banking Integration

This is essential for those that want their accounts to be regularly updated with real time bank transactions.

Direct Connect (known as QFX in Quicken products) is the standard method that most banks support although increasingly, users are finding it very unreliable.

Sometimes this is not an application’s fault and is due to changes made by banks on how third party software connects to them.

Some banks such as Citibank have even dropped support for Direct Connect in favor of their own proprietary system instead.

As a result, some applications such as Moneyspire, Banktivity and Moneydance have developed their own version of Direct Connect although this usually costs extra.

However, Moneyspire’s reliable Moneyspire Connect service is now included for free in the price of the product which makes it a very good deal indeed.

Note that some banks may levy a small charge for connecting your account to a third-party app via Direct Connect so it’s always wise to check with your financial institution first.

- Bill Pay

It’s important to be aware that just because an app supports online banking, doesn’t necessarily mean it supports Bill Pay.

Bill Pay enables an application to automatically pay your bills to help keep on top of them.

Of course, you can do this easily by setting up a Direct Debit with your bank for things such as utility bills but Bill Pay enables your finance app to track them more easily.

- Account Reconciliation

Not all personal finance apps allow you to reconcile accounts manually.

This is essential if you’re trying to manage a budget but get payments that fall on the first of the month but it happens to be a weekend or holiday.

In such cases, many apps will automatically enter the transaction on the last previous banking day and there’s no way to change this.

- Encrypted Connections

When it comes to security, remember that any connection made between finance apps and your bank are only as safe as the application accessing it.

Make sure that the application takes security seriously and uses encrypted connections to your bank to prevent unauthorized interceptions.

A few apps such as Personal Capital add an extra layer of protection by not actually storing your financial credentials but managing access via specialized encrypted service Yodlee.

This is also used by many financial institutions and adds an extra layer of protection to your data.

- Investment Tracking

This is essential to track loans, assets, stocks, shares and bonds etc.

One of the big gripes Mac users have with Quicken is that it doesn’t do a good job of tracking basic things like car loans or home loan amortization (although fixed interest rate tracking was introduced in Quicken 2017).

Alternatives such as Personal Capital, Banktivity and Moneydance all feature robust investment tracking as standard.

- Mobile Apps

If you like to manage your money or check accounts on the move, make sure the software you choose has a mobile app.

Most apps that have a mobile app sync accounts with your iPhone or iPad although many are limited in functionality and don’t allow you to make many transactions. Some user their own servers to sync while others offer syncing via iCloud.

If you like to take photos of receipts and invoices to sync with your Mac later, make sure this feature is supported.

- Quicken Import Support

If you want to import your Quicken accounts into another application, you can easily do so by exporting them into QIF format.

Unfortunately, Quicken 2019 has removed the option to export files in QIF format. It now only exports in QXF which is a proprietary Quicken format that can’t be imported into any program.

Therefore, there’s no way to import Quicken 2019 files into any personal finance app anymore but earlier versions of Quicken can.

Note that not all personal finance software supports QIF importing so if this is important to you, make sure you can migrate from Quicken easily.

Note that no Mac personal finance app will import Quicken files 100% perfectly – there will always be some manual correction necessary.

- Multiple Currencies

For those that travel a lot or that deal with foreign transactions regularly. The Mac edition of Quicken is still lagging behind when it comes to multiple currency transaction support.

Those that imported foreign currency accounts into Quicken 2018 for example found that they were suddenly converted to dollars.

Make sure foreign currencies are supported if you do a lot of trade abroad to avoid some major headaches when importing data.

- User Profiles

If you share the software with a partner, other members of your family or colleagues, support for creating multiple profiles is very useful.

It allows you to track spending and create budgets for each individual member whilst also preserving the privacy of each user.

Some financial software only allows one user per license and some don’t support more than one profile so bear this in mind if you’re intending to use the program with other.

We hope this article has helped you be more informed when choosing a replacement for Quicken on your Mac.

This is by no means a definitive list of programs to replace Quicken with on your Mac. There are other options (examples include LiquidLedger and moneyGuru) but we haven’t included them as most are now very dated and can’t compare to the latest version of Quicken anymore.

If you have any other questions, experiences or suggestions regarding the software featured here, let us know in the comments below.

You May Also Like:

Want to replace Quicken? We’ve got you covered.

As the granddaddy of personal finance software, Quicken was once the best money management tool on the market. Heck, it was practically the only tool on the market. Now? Not so much.

Though it was all the rage back in the day, little has been done over the last few years to improve Quicken. In fact, Intuit (famous for programs like Quickbooks and Turbo Tax) actually sold off their ownership rights to Quicken back in 2016. Since then, rumors have swirled that Quicken will actually shut down its program for good.

Luckily, Quicken is not your only choice for personal finance software. These days, there are a number of alternatives that can help you manage your money as well as Quicken ever did…and for less money. In fact, some of the best Quicken alternatives are actually free!

So, if you’re looking for a new program to manage your money, you’re in the right place. Check out our list of the top 10 Quicken alternatives below.

Table of Contents

- 16 Best Alternatives to Quicken

Our Top Picks

Personal Capital [Editor’s Choice] – Personal Capital is our Editor’s Choice for Quicken alternatives. This free software automatically tracks your savings, spending, investments, net worth, and more. It’s easy to use and the free price tag makes it an excellent replacement for Quicken. We’ve used it for years and think you’ll love it too! Read the review | Learn more

Tiller – If you’re looking for a budgeting tool that also runs some basic financial reports, Tiller is it. This program takes spreadsheet budgeting to the next level by helping you create a monthly budget and automatically tracking your results. When it comes to tax prep, Tiller can also run detailed reports on itemized deductions, your annual spend by category, and more. Start with one of their templates, customize it to meet your needs, or build your own. Get it free for the first month, then it’s only about $5 a month. Read the review | Learn more

16 Best Alternatives to Quicken

1. Personal Capital

Personal Capital is our favorite money management software of all time. We’ve used it personally for years, and we continue to be amazed by this powerful software.

What’s so great about Personal Capital? For starters, it’s free.

That’s pretty awesome considering they offer a comprehensive collection of money tools in one convenient place. Here, you can track your spending, net worth, and investments. You can also use it to check your investments for expensive fees and calculate whether you’re saving enough for retirement. These tools are all 100% free and at your disposal after a simple sign up process.

So, how does it work?

In short, Personal Capital synthesizes the data from all your accounts and delivers a complete financial picture that’s easy to understand.

Just link Personal Capital to your bank, credit, and investment accounts and let the program do the heavy lifting. It imports your transactions and calculates how your spending aligns with your budget.

Unlike some other alternatives to Quicken, Personal Capital is more than just budgets. And, since it is free, it makes a great compliment to some of the other programs as well.

Personal Capital also offers a powerful investment management tool. It tracks your asset allocation, monitors your investment performance, and analyzes your fees. It even takes your retirement goals into account and estimates your retirement income/expenditures based on your financial data. And, of course, Personal Capital also calculates the value of your assets relative to your debt (i.e. your net worth).

It might sound like a lot going on, but the app is incredibly user-friendly. A summary of your financial situation is available on the dashboard as soon as you open the app.

With all these money tools being offered for free, you might be wondering how Personal Capital actually makes money. Good question. They also offer fee-based wealth management services. Those are entirely optional, and you’re in no way obligated to subscribe. Tons of users enjoy the free suite of tools without using the wealth management services.

In my opinion, Personal Capital offers the best free money management software on the market. With a robust collection of money tools and a free price tag, this program blows many of the other alternatives to Quicken out of the water. Check out our complete Personal Capital review for more information!

2. Tiller

Tilleris a relative newcomer as a money management software program. This financial tracking tool is used in conjunction with Google Sheets (Gmail account required). So, if you’re into spreadsheets, Tiller might be just your thing.

Although it started out as solution for budgeting, Tiller has become more than just a budgeting program. Tiller can help you prepare for tax season by running detailed reports on your itemized deductions, annual spending by category, and more. For self-employed people and freelancers, they also offer a nifty tool that helps you determine your estimated quarterly taxes. They also provide a debt snowball worksheet and some simple net worth tracking.

To get started, simply link your bank accounts to the program. Then, Tiller will automatically download your financial transactions into Google Sheets on a daily basis.

From there, you’re free to take advantage of Tiller’s limitless customization options. They provide multiple budgeting templates you can use, but you can also create a brand new spreadsheet unique to your preferences.

Every day, Tiller emails you a summary of your financial activity so you always know exactly what’s happening with your money.

You can try Tiller free for 30 days to see if it meets your needs. After that, it’s about $5 a month, or free for a year if you’re a student.

3. YNAB

You Need a Budget (YNAB) is an excellent choice for anyone who wants an easy to use and effective budgeting app.

YNAB doesn’t offer a whole suite of money tools like Personal Capital. It focuses on two things: building a realistic budget and tracking your spending. And that’s ok, because it does them both very well.

I say a realistic budget because YNAB’s philosophy is that a budget is fluid and should be adjusted frequently in response to what’s going on in our lives. That’s why YNAB makes it so easy to move money between spending categories to keep your budget balanced.

For example, if you’ve budgeted $300 for groceries, but your transactions indicate that you’ve spent $340, YNAB will notify you that you’ve overspent and prompt you to deduct that $40 from another category. This system is especially useful if your goal is to maintain a zero-sum budget.

When you use YNAB, you have two choices. You can either automatically import your transactions by connecting to your bank and credit providers, or you can enter your transactions manually. Obviously, automating things is easier, but some may appreciate the option to do things the old-fashioned way.

YNAB offers a free 34-day trial, so you can try a full month of budgeting with no commitment. After that, the cost is $6.99 a month, billed annually. That means once a year, you’ll pay $83.88 to use the app/software. Unless you’re a student – then you can enjoy 12 months for free – which is a pretty cool benefit.

Also cool is that YNAB offers a 100% money-back guarantee. So, if you buy the app and decide it’s not helping you take control of your finances, YNAB will give you a full refund. Can’t argue with that!

4. Mint

Mint is a comprehensive financial tool that Quicken enthusiasts will probably appreciate. In fact, Intuit acquired Mint in 2010 shortly before they dropped Quicken from their suite of financial tools. Stew on that for a minute and think about which program Intuit thinks is better 🙂

Like with some of the other Quicken alternatives, when you link your financial accounts to Mint, you have access to your whole financial picture in one place.

As we mention in our full Mint review, you can build a budget, track your spending, monitor your investments, and manage your bills. The bills feature is really nice for people who haven’t automated their bill payments and want the ease of managing them on one platform.

Mint also lets you check your credit score and explains how it’s calculated. I think this is pretty neat because a lot of people don’t know their credit score or understand how these scores work.

With all that under one roof, you might be surprised to learn that Mint is free. Hey, we’ll take it.

5. PocketSmith

If you want to get a better handle on your money, PocketSmith might be for you. Like several of the best alternatives to Quicken, this program provides a strong option for budgeting. Where it really shines, however, is with its financial forecasting.

Instead of simply tracking what you’ve already spent, PocketSmith also helps you see what the future holds for your money. The “budget calendar” provides a daily look at your future income and expenses, all on an easy-to-read calendar so you can plan appropriately. Using your current info, you can even project your bank account balances as far out as 30 years into the future.

Our favorite feature is the “what if” scenarios. This feature allows you to test different spending and saving decisions and see how they affect your future financial growth. Wondering how reducing your grocery spending will affect your savings rate? Want to take a $2,000 vacation next summer? Use the “what if” feature to understand both the short-term and long-term consequences.

As with most Quicken alternatives, PocketSmith utilizes live bank feeds to update your transactions automatically. Over 10,000 different financial institutions are supported, so it’s pretty likely that you’ll be able to connect your accounts.

The basic functions of PocketSmith can be used for free, however you are limited to connecting just 2 accounts and 6-months of projections. The Premium version runs $9.95 per month and comes with 10 accounts and 10 years of projections. Unlimited accounts and 30 years of projections are available with the “Super” account which runs $19.95 per month.

6. CountAbout

CountAbout web-based personal finance software is another contender for the best Quicken alternatives. This program actually supports importing data from both Quicken and Mint, which is nice.

When you use CountAbout on a computer, there’s no app to install; you simply log in to their website. They do offer a mobile app for iOS and Android, but not all the features are available through the app.

Use CountAbout to create a customizable budget; then, sync it to your bank account to automatically import your transactions and track your spending. You can get a snapshot of your financial activity with widgets, or general full financial reports.

CountAbout offers two membership options: basic for $9.99 a year or premium for $39.99 a year. The only difference between the two is that the basic membership does not support syncing with online bank accounts. That means if you opt for the basic membership, your transactions will not be automatically downloaded. Your options are to enter transactions manually or import QIF files from your bank if they make those available.

If you’d like to try CountAbout before committing, you can get their 15-day free premium trial.

7. Moneydance

Moneydance is another viable personal finance software alternative to Quicken. In fact, if you currently have Quicken data, you can import it into Moneydance. It’s available as a desktop app for all the major operating systems and as a mobile app.

Moneydance’s interface kind of resembles a check register, where you see a record of all your transactions. Those transactions can be imported automatically by syncing with your online banking, or you can enter them manually. If you choose the automated route, you can also manage bill payments through Moneydance.

Of course, it wouldn’t be personal finance software without the ability to create a budget. Moneydance lets you create spending categories and track your expenditures. If you’re a visual person, you’ll appreciate the interactive graphing tool. You can also use Moneydance to track your investments and monitor stock performance.

If you’re technologically inclined (i.e. a tech nerd), you can actually develop extensions for Moneydance using an Extension Developer Kit they offer as a free download. But I won’t get into that today!

You can try Moneydance using their free trial, which works a bit differently than the other trials we’ve talked about. There’s no time limit on their trial, but you’re limited to 100 manually entered transactions. Still, that’s enough to decide if Moneydance is for you. After that, you can buy the full program for a one-time fee of $49.99. They also offer a 90-day money back guarantee when you purchase from their website.

8. Banktivity

Banktivityis a personal money manager made for Mac users. The newest version, Banktivity 7, is designed specifically for MacOS Sierra. And – like Moneydance – when you turn to Banktivity as a Quicken replacement, you can import your data for a seamless transition.

With Banktivity, you’ll sync your bank accounts and use it to build budgets, track your spending, pay your bills, and monitor your investments.

They also offer some really cool reporting options. For example, you can generate reports based on category spending or spending at a given merchant. So, if you want to track how much you spend on eating out, you can easily generate a report showing all your spending in that category over a given time frame. Or, if you want to get even more specific, you can easily pull up how much you spent on McDonald’s in the past two weeks.

The “Find” feature in Banktivity is kind of like Mac’s spotlight – it lets you search all your transactions to find the one you’re looking for. This can be a great time saver when you’re trying to quickly check something specific.

Banktivity offers a free 30-day trial, no credit card required. After that, you can purchase the desktop app for a one-time fee of $69.99. You can then download the app on iPhone and iPad and sync across your devices.

9. GoodBudget

GoodBudget is a simple budgeting app that helps you plan and track your spending through a digital version of the envelope method.

If you’re unfamiliar with the envelope method, this is a style of budgeting where you use an envelope for each spending category. First, you’ll plan how much you’ll spend on each category (usually throughout the month). Then, you allocate cash for those expenses in each category’s designated envelope.

Throughout the month, you’ll take money from a designated envelope each time you need to spend in that category. If you run out of money in an envelope, you can’t spend any more on that category… unless you borrow the money from another envelope (which will reduce your spending power in that category).

The free version of GoodBudget gives you twenty envelopes and allows you to download transactions from one bank account. You can also sync across two devices – which is great for using it on desktop and mobile. You can also use one sync to share a budget with your partner.

GoodBudget Plus costs $6 a month or $50 a year. This gives you access to unlimited envelopes and bank account syncing. You can also use the app on five different devices.

Since you’re likely to have more than one account and may both want access on multiple devices, GoodBudget Plus is probably more practical for a couple who shares a budget. That being said, it’s great that this software also has a free option.

10. Dollarbird

Dollarbird is another simple, no-frills budgeting app that makes for a good alternative to Quicken. This app is unique in that it’s calendar-based rather than category-based. What this means is that Dollarbird focuses on tracking your income and spending by day, rather than by category.

So, when you open the app, you’ll see a calendar. From there, you have the option of adding transactions (income or spending) for each day. Although you do categorize your transactions, the app displays your net spending per day rather than a running category total.

At this time, Dollarbird does not support syncing with your online accounts. This means all your transactions must be entered manually. However, you can schedule recurring transactions so you’re not constantly required to enter your regular fixed expenses. If you’re paid a regular salary, you can do the same with your paychecks.

The free version of Dollarbird gives you access to one calendar – perfect if you’re doing a simple solo budget.

The paid Pro version allows up to 20 calendars and can be accessed by three people. Again, the paid option might be more practical for couples. You can opt to pay $3.99 monthly or $39.99 for the year.

11. Everydollar

Next on our list of Quicken alternatives, we have Everydollar. If you’re a Dave Ramsey fan, you may want to give his budgeting tool a try.

Everydollar lets you budget your income into customizable spending categories, then enter your transactions and track your spending. The free version doesn’t link to your online accounts, so you enter your transactions manually. (If you want to automatically sync to your online accounts, you’ll need the paid version.) That’s not a deal breaker, but one thing I’ve noticed is that the app doesn’t seem to remember the category associated with a payee that’s previously been entered. Adding that would be a nice touch.

This is a super simple budgeting app that should meet the needs of someone who wants to get started with planning a budget and tracking their spending. It’s free, so there’s no risk involved in trying it out for a few months to see what you think.

12. PocketGuard

If simple smartphone apps are more your thing, PocketGuard deserves your consideration.

PocketGuard helps you budget your money, track your spending, and lower your bills. Better yet, it is available for both iOS and Android devices.

To get started, simply connect your credit cards, bank accounts, investments, and loans to the app. Your info will sync to the app and update automatically as transactions happen.

Although it’s not as powerful as the best Quicken alternatives, it can certainly help you keep an eye on your finances. Like some of the other programs, this app helps you see the balance of your connected accounts all in one place. It can also help you track and categorize your spending, set monthly income and spending goals, and provide tips on where you can save even more. The “in my pocket” feature even shows the amount of money you’ve got available to spend after accounting for all of your bills and savings goals.

PocketGuard’s main features are free. It’s worth noting, however, that they also offer a paid version called PocketGuard Plus. The upgrade offers significantly more customization (including custom categories, cash transactions, etc.) and costs $3.99/month or $34.99 if you pay annually.

13. MoneyWiz

MoneyWiz is another alternative to Quicken that works with Apple, Android, and Windows devices.

With this app, you can easily sync all of your financial data into one place. It also boasts a live syncing feature which allows you to sync data between devices in real-time.

Using MoneyWiz for budgeting is also a breeze. The app allows you to create different budgeting categories which you can set up as a one time or recurring category. Balances can be rolled over from one period to the next, and the program will even monitor your accounts for transactions – automatically updating the relevant information as you go. You can also transfer money between categories, similar to the “envelope” method.

In addition to the automatic syncing functions on the premium version of the app, MoneyWiz also allows you to enter your transactions manually. It is also capable of creating multiple reports and graphs, including custom financial reports.

So, if you’re looking to replace Quicken, MoneyWiz may be worth a try. While there is a stripped down version that’s free, you can get all the functionality by purchasing the premium version for just $4.99 a month or $49.99 per year.

14. Status Money

Are you competitive about your finances? There’s an app for that.

Status is a free program that allows you to compare your financial situation with your peers. Simply connect your accounts and start comparing right away. Then, use those comparisons as motivation to improve your own financial situation!

Of course, Status is about more than just comparing yourself to others. With Status, you can track your net worth, create spending goals, and monitor your credit. The program also analyzes your saving and spending by category, offering suggestions to improve your situation along the way.

Although Status is not nearly as robust as many of the other options, it is free to use. (It is ad supported, so keep that in mind when considering their suggestions.) So, while it may not be the perfect Quicken replacement, it won’t cost anything for you to test it out.

15. Wally

Wally is another personal finance app available for use on your smartphone. This app focuses entirely on budgeting and tracking your expenses. So, if you’re somebody who needs help with those two things (and who doesn’t?), Wally may be for you!

Although the app is attractive, it isn’t very complex. Unlike almost every other program on this list, with Wally, you won’t connect your accounts. For those who are a little skittish about cloud-based apps, this may actually be seen as a plus.

Quicken For Mac 2018 Vs Quicken For Windows

Effectively, Wally is like using a paper budget…except it’s on your smartphone. You’ll have to manually enter your income and transactions, although you do have the ability to create recurring expenses for bills that stay the same every month.

Quicken 2018 Windows Vs Mac

Even though it lacks automation, Wally does a good job of doing what it sets out to do – help people manage their monthly budgets. Once you set it up, you’ll be able to quickly compare your monthly income to your expenses, helping you to get a firmer grasp on your finances.

Wally was originally available just for iPhones, but they recently unveiled a new version for Android. According to their website, the app is (and always will be) free. There are plans to add some paid features, but we’ll have to wait and see what those are when they are rolled out in the future.

16. GnuCash

GnuCash is a free open-source financial management software that runs on some Windows and Apple operating systems.

The app uses the double-entry accounting method to help you keep track of your finances. Business owners should already be familiar with this concept as it is the preferred method used for balancing books and keeping accurate financial records for companies.

With that said, the app can help with your personal finances as well. Through GnuCash, you can track your bank accounts, income, expenses, and investments. If you’re planning to replace Quicken, you can input your information directly from your old software. GnuCash is also capable of running a variety of financial reports for those who need them.

GnuCash is typically better for those who have a business and isn’t a perfect fit for most people’s personal finances. However, it is free, so it may be worth a try.

Quicken Alternatives: Final Thoughts

Quicken 2018 For Mac Download

With Quicken no longer the only financial tracking game in town, there are plenty of options to choose from. Whether you’re looking for a simple budgeting program or a complete personal finance software package, there’s enough variety on this list to suit almost any need.

Quicken For Windows Vs Quicken For Mac 2018 Amazon

Although everybody has their preferences (us included), ultimately, the best financial tools are ones you’ll use consistently. So why wait? Use one of the links above to download a free app or start a free trial to find out what program works for you.

Quicken For Mac 2018 Trial

How many of these money management tools have you tried? Which is your favorite? Let us know in the comments!