I have fond memories of using Quicken. As crazy as this may sound, Quicken showed me just how powerful computers could be. I was no longer just playing games or a writing programs to count to 100. I was managing my finances on a computer.

There are, however, several great alternatives to Quicken and Mint. We'll look at five of the best replacement options, the first of which is an advertiser on my personal finance blog. It also happens to be my favorite and the one I use every day.

Personal Capital

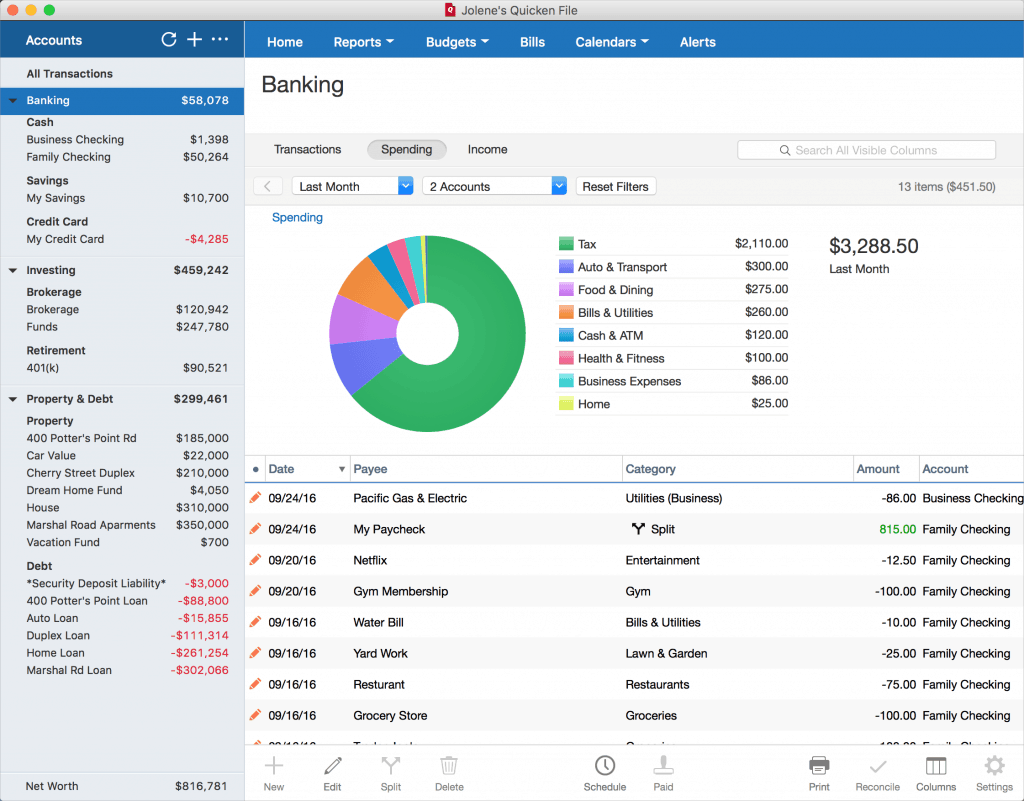

- Quicken today announced the launch of Quicken 2019, the newest version of its popular finance and budgeting software for PC and Mac. Quicken 2019 introduces web access for the first time, designed.

- One of the biggest new features for 2018 is Quicken’s expanded Mac options. For the first time, Mac users can decide between different products based on what suits their needs.

Personal Capital has become an extremely popular tool to manage money. There are several reasons for this. First, it's free.

Second, Personal Capital's financial dashboard manages every aspect of a person's finances. It tracks cash flow and enables you to see your spending by account and category. Further, it's a great tool to track your investments.

It uses a familiar spreadsheet format that' s="" very="" easy="" to="" use.="" categories="" can="" be="" assigned="" to="" your="" spending="" automatically.="" once="" you've="" used="" the="" software="" for="" about="" a="" month,="" you'll="" rarely="" need="" to="" categorize="" expenses="">

And YNAB follows a very interesting approach to budgeting. The goal is to live off of money you earned the previous month. As a result, you're not living paycheck to paycheck. It may take some time to get there, but I've found YNAB the best tool to support this type of prudent financial management.

Banktivity

Add the hard drive Now it's time to add our virtual drive. Click on 'Edit virtual machine settings.' Best virtual machine for mac 2018.

Quicken For Mac

For those with a Mac looking for software, Banktivity is an excellent choice. Much like Quicken, you can connect bank accounts, credit cards, mortgages, and even investment accounts. Once connected, Banktivity manages your entire financial life in one place.

We prioritize updates primarily based on feedback from these users, and adding web access was the number one requested enhancement,' said Eric Dunn, Chief Executive Officer of Quicken. Quicken for mac 2018 user guide. 'As an agile, independent company, we've been able to deliver this highly-anticipated feature, among other exciting new customer-inspired updates, on schedule and with great quality. Quicken 2019 also features several enhancements on the desktop, which are designed to offer up an overall faster experience. This increased pace of releases and improvements is something our customers can count on and look forward to in the future.' Because Quicken is important to them, our community of users is incredibly engaged.

I've found connecting accounts to be, while not perfect, workable. I've successfully connected investment accounts from major brokers, a mortgage on an investment property from Chase, and credit cards from Citi, Capital One and other issuers.

What I've found most appealing about Banktivity is that it just works. There is, however, one downside. The cost. The software set me back $64.99, which by itself would be fine. However, if I want to automatically download transactions, I must pay a yearly fee of nearly $45. In the end, the cost was worth it. But it's an important consideration, particularly when tools such as Personal Captial are free.

EveryDollar

For Dave Ramsey fans, EveryDollar is a good option. It is an online budgeting and money management tool. It comes in both a free and paid version. The paid version adds, among other things, online connectivity to your financial institutions.

The budget is broken down into categories, such as housing, transportation, and food. You can customize expense categories. Without the paid version, however, it's an entirely manual process.

For those following Dave's Baby Steps, they are integrated into the budget. For example, save $200 and you'll see Baby Step #1 (save $1,000 for emergencies), increase by $200.

2018-11-21 2018/2019 Release of Quicken for Mac (Subscription Product) Release Notes. Product Version. 166 people found this helpful. You may cancel before renewal date. For full details, consult the Quicken Membership Agreement. Quicken for mac 2018 release date.

PowerWallet

The last Mint and Quicken alternative on our list is PowerWallet. This online budget tool enables you to link bank accounts, credit cards, loans, and investment accounts. I found the linking process to be smooth, with two exceptions. I was unable to link a retirement account at Fidelity and credit cards from Citi.

PowerWallet uses a cash flow model of budgeting. In the dashboard, it shows your cash inflows, outflows, and what's left. It also highlights your top spending categories. It does use an advertising model for revenue, so be prepared to see some advertisements.

Connectivity

One persistent problem with all personal finance software is issues connecting to financial institutions. I have yet to use one that didn't have at least one or two problems. I've found Personal Capital to be the one tool with the fewest problems. But you should expect to encounter some connectivity issues regardless of which tool you use.

'>I have fond memories of using Quicken. As crazy as this may sound, Quicken showed me just how powerful computers could be. I was no longer just playing games or a writing programs to count to 100. I was managing my finances on a computer.

From slide rule to online budget apps. Here are 5 alternatives to Quicken and Mint. (AP Photo)

Mint had a similar effect, only with the Internet. Now no longer tethered to a hard drive, I could manage my finances from any place where I could get an internet connection.

Quicken For Mac 2007 Vs 2018 Calendar

Sadly (or not), both programs have lost a step or two. Quicken is clunky by today's standards. And I've heard multiple complaints about Mint, especially about updating information from financial institutions.

There are, however, several great alternatives to Quicken and Mint. We'll look at five of the best replacement options, the first of which is an advertiser on my personal finance blog. It also happens to be my favorite and the one I use every day.

Personal Capital

Personal Capital has become an extremely popular tool to manage money. There are several reasons for this. First, it's free.

Second, Personal Capital's financial dashboard manages every aspect of a person's finances. It tracks cash flow and enables you to see your spending by account and category. Further, it's a great tool to track your investments.

The results of running Personal Capital's fee analyzer on my 401k.

Rob BergerIt enables you to link all of your investment accounts. Once linked, Personal Capital provides a wealth of information about your portfolio. From asset allocation to investing fees, this tool gives you easy insight into your investment portfolio. This is particularly helpful if you, like me, have multiple retirement and taxable accounts.

Finally, Personal Captial offers a retirement planning tool. You can see if you are on track to retire as planned. It even provides useful data on 529 accounts you may have for your children and tracks the value of real estate.

YNAB

For those focused exclusively on their budget, there's nothing better than YNAB (short for You Need a Budget). I've tried virtually every budgeting tool available, and YNAB is without question the most effective.

It uses a familiar spreadsheet format that's very easy to use. Categories can be assigned to your spending automatically. Once you've used the software for about a month, you'll rarely need to categorize expenses manually.

And YNAB follows a very interesting approach to budgeting. The goal is to live off of money you earned the previous month. As a result, you're not living paycheck to paycheck. It may take some time to get there, but I've found YNAB the best tool to support this type of prudent financial management.

Banktivity

For those with a Mac looking for software, Banktivity is an excellent choice. Much like Quicken, you can connect bank accounts, credit cards, mortgages, and even investment accounts. Once connected, Banktivity manages your entire financial life in one place.

I've found connecting accounts to be, while not perfect, workable. I've successfully connected investment accounts from major brokers, a mortgage on an investment property from Chase, and credit cards from Citi, Capital One and other issuers.

What I've found most appealing about Banktivity is that it just works. There is, however, one downside. The cost. The software set me back $64.99, which by itself would be fine. However, if I want to automatically download transactions, I must pay a yearly fee of nearly $45. In the end, the cost was worth it. But it's an important consideration, particularly when tools such as Personal Captial are free.

EveryDollar

For Dave Ramsey fans, EveryDollar is a good option. It is an online budgeting and money management tool. It comes in both a free and paid version. The paid version adds, among other things, online connectivity to your financial institutions.

The budget is broken down into categories, such as housing, transportation, and food. You can customize expense categories. Without the paid version, however, it's an entirely manual process.

For those following Dave's Baby Steps, they are integrated into the budget. For example, save $200 and you'll see Baby Step #1 (save $1,000 for emergencies), increase by $200.

PowerWallet

The last Mint and Quicken alternative on our list is PowerWallet. This online budget tool enables you to link bank accounts, credit cards, loans, and investment accounts. I found the linking process to be smooth, with two exceptions. I was unable to link a retirement account at Fidelity and credit cards from Citi.

PowerWallet uses a cash flow model of budgeting. In the dashboard, it shows your cash inflows, outflows, and what's left. It also highlights your top spending categories. It does use an advertising model for revenue, so be prepared to see some advertisements.

Quicken Premier 2018 Download

Connectivity

Quicken For Mac 2007 Free Download

One persistent problem with all personal finance software is issues connecting to financial institutions. I have yet to use one that didn't have at least one or two problems. I've found Personal Capital to be the one tool with the fewest problems. But you should expect to encounter some connectivity issues regardless of which tool you use.